Crypto markets are down 0.48%, reflecting the drop in stock markets and technical pressures on Bitcoin.

Crypto markets faced minor selling pressure from both macroeconomic factors and Bitcoin technicals. On Tuesday, May 6, the overall crypto market cap declined 0.54%, falling below $3 trillion to $2.94 trillion.

The main driver of the decline mirrored the same factors weighing on equities. The Dow Jones lost more than 400 points, or 1.00%, while other major indices also fared poorly. Typically, Bitcoin (BTC) and the broader crypto market, are correlated with stocks, which likely means that similar factors influence both.

In this case, macroeconomic uncertainty and renewed fears over Donald Trump’s tariffs contributed to the bearish sentiment. Notably, just a day prior, Trump announced new tariffs on pharmaceuticals, after already targeting movies. These new tariff announcements are causing concern among traders, as they suggest Trump is not backing away from his aggressive trade stance.

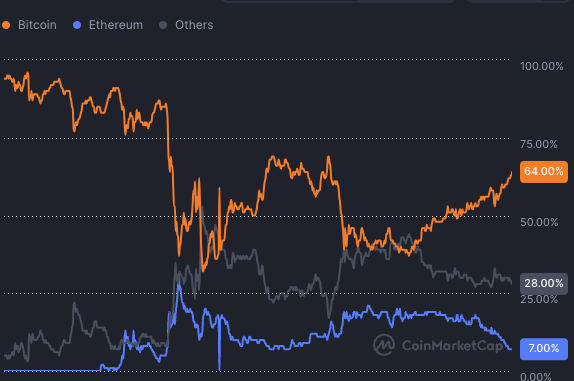

Despite the overall decline, Bitcoin was more resilient than most altcoins, managing to increase its dominance to 64.1%, the highest level since January 2021. Still, while Bitcoin recovered some of its earlier losses today from a low of $93,400, its price is still just slightly below what it was 24 hours ago, registering a 0.01% loss at $94,841.

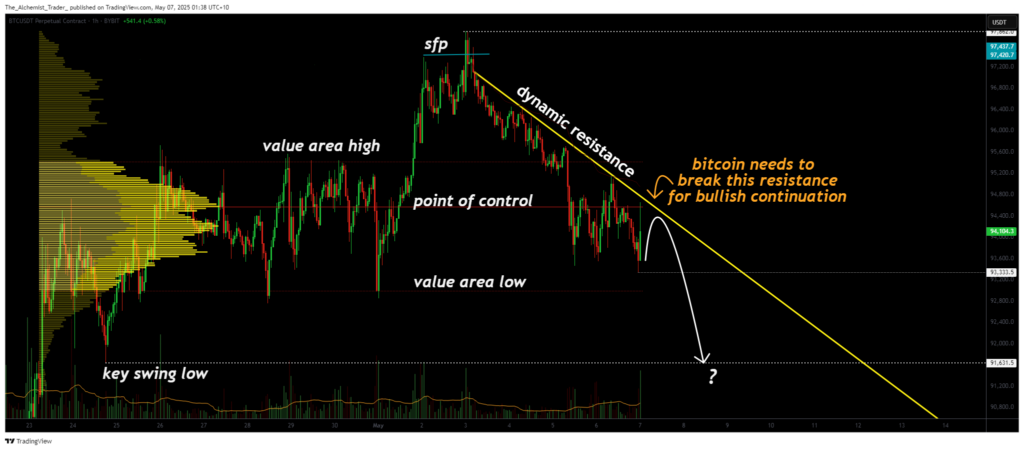

Bitcoin faces technical pressures

One of the reasons for Bitcoin’s underwhelming performance comes down to technical factors, which is unlikely to change very soon. Specifically, Bitcoin is facing a long-term dynamic resistance that started forming after its all-time high in January.

Since then, Bitcoin has consistently stayed below the resistance point, with a last breakout attempt on April 23. This means that further declines are likely, especially as its price has passed the point of control. That is, unless a major catalyst enables it to break this long-term resistance.