The XRP price is on the verge of a 35% surge to its year-to-date high as inflows into the Teucrium 2x Long Daily XRP ETF continue.

Ripple (XRP) was trading at $2.5270 on Tuesday, up over 55% from its lowest level this year, giving the token a market valuation of nearly $150 billion.

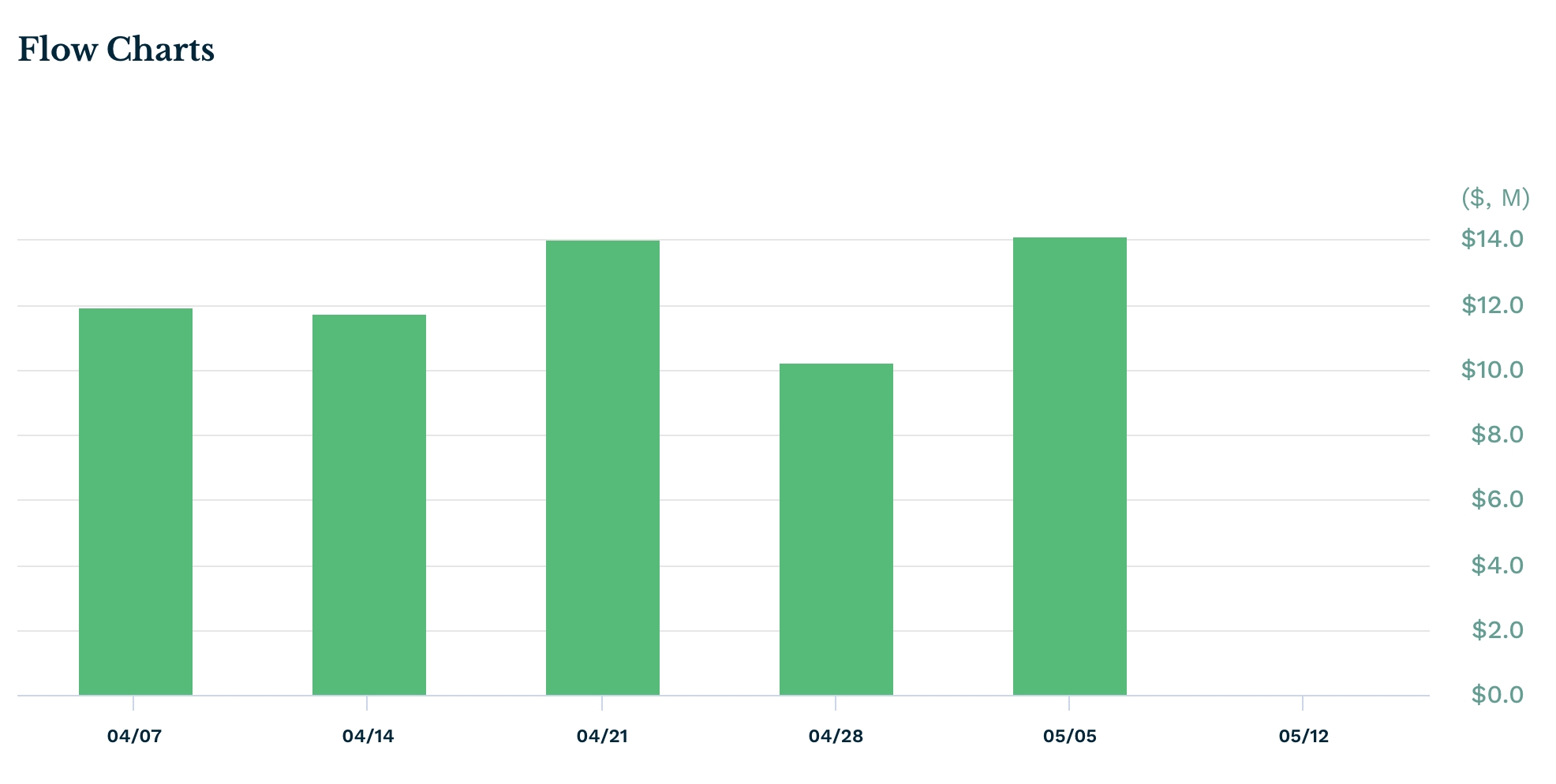

Data shows that the XXRP ETF has recorded inflows for five consecutive weeks, bringing its total assets to more than $99.1 million. It added $14 million last week, up from $10 million the previous week.

The sustained growth of the XXRP ETF highlights rising demand for XRP-linked investment products — despite its relatively high annual management fee of 1.89%. For comparison, the ProShares Bitcoin ETF charges an expense ratio of 0.95%.

This demand comes as optimism grows that the U.S. Securities and Exchange Commission (SEC) will approve spot XRP ETFs from firms such as Franklin Templeton, Grayscale, 21Shares, Canary, and CoinShares. According to Polymarket, the odds of approval have climbed to 80%.

Analysts are also bullish on the potential impact of these approvals. JPMorgan estimates that spot XRP ETFs could see $8 billion in inflows during their first year, surpassing the inflows Ethereum (ETH) ETFs have accumulated since their approval last September.

XRP has other bullish catalysts that may support further price appreciation. Ripple Labs has become a key player in the stablecoin market with its Ripple USD (RLUSD) token, which currently has a market cap of over $300 million. The company is also reportedly in talks with Circle, the issuer of USD Coin, the second-largest stablecoin by market cap.

Ripple Labs has moved into the prime brokerage industry through its Hidden Road purchase and is actively working to become a major player in the cross-border payments industry.

XRP price technical analysis

The daily chart shows that XRP has recovered strongly after bottoming at $1.6218 in April. The price has now broken above the 50-day moving average, a sign that bullish momentum is building.

XRP has also formed an inverse head-and-shoulders pattern, a classic bullish reversal formation. The head sits at $1.6218, while the shoulders are anchored near the $2 level.

Also, the Average Directional Index has moved to 20, a sign that the trend is strengthening. Therefore, the most likely XRP forecast is where it rallies and hits the YTD high of $3.40, up by 35% above the current level.