Bitcoin is back above $103,000 and the largest crypto is eyeing a re-test of all-time highs above $109,588. At a time when nearly all tokens in the top 100 cryptocurrencies ranked by market cap are in the green, the market is abuzz with the debate of whether to stay or sell and go away in May?

Millionaire exits are not uncommon in crypto and the meme coin bull run in 2024 was marked by Solana-based (SOL) meme token exits by traders. As Bitcoin (BTC) eyes a return to its all-time high, riding on the bullish sentiment from recent catalysts, macroeconomic certainty, U.S. trade deals with the UK and China and rising institutional demand and acceptance of stablecoin and BTC, a crypto exit plan is more relevant than ever before this cycle.

Meme coin millionaire’s missed exit

Glauber Contessoto, popular as the Dogecoin (DOGE) millionaire, who maxed out credit cards and spent his savings to buy $250,000 worth of DOGE in February 2021. Contessoto has also gained notoriety as the man who once held nearly $3 million in DOGE and lost his gains when the crypto market tanked in 2022.

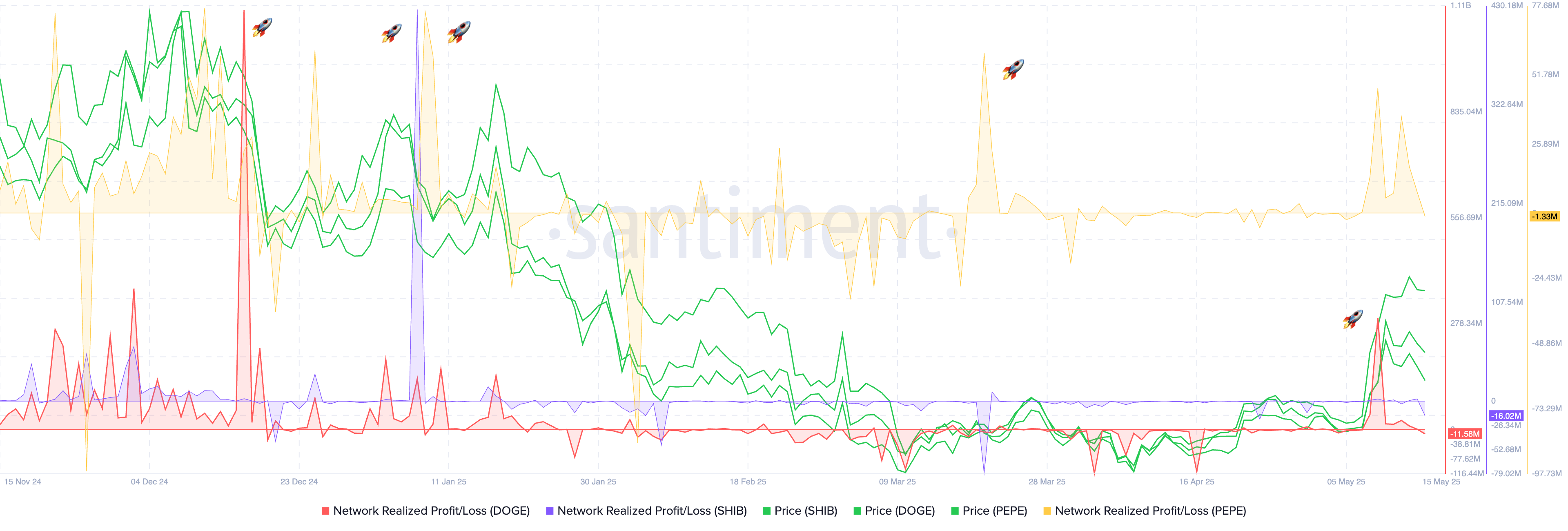

Contessoto inspired fast-acting traders to take profits when the token nears a potential peak. On-chain data from Santiment shows that for the top three meme coins, DOGE, Shiba Inu (SHIB) and Pepe (PEPE), over the past year, a large volume of traders have realized gains close to, or soon after a local top.

The large spikes in profit-taking nearly coincide with local tops as seen in the chart below:

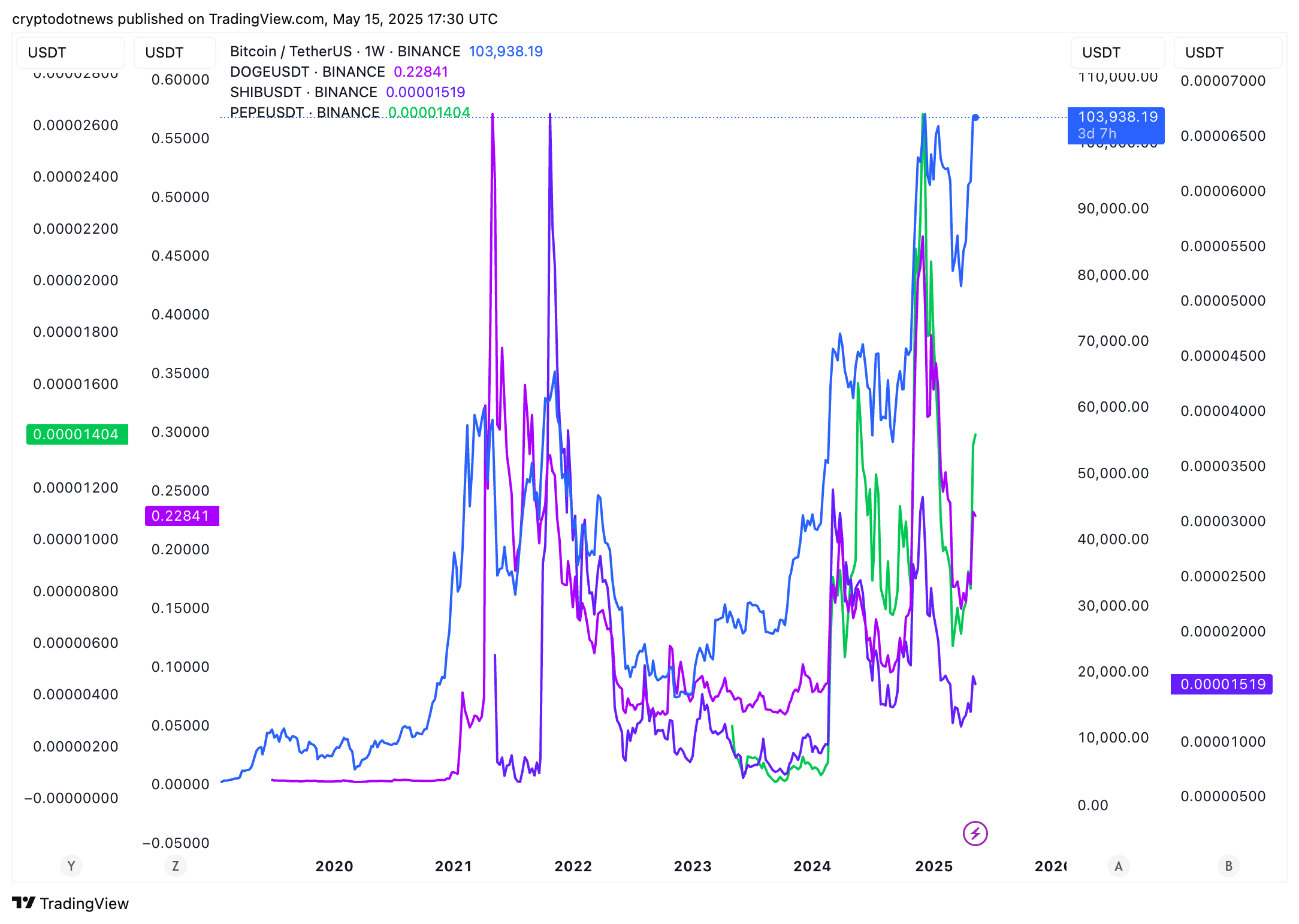

It is therefore becoming increasingly necessary to take profits near local tops, typically alongside Bitcoin’s local tops, as seen in the price chart below.

Stay in May or sell and go away?

There is a popular stock market theory that says the market tends to underperform in the six months between May and October, leading to the old adage of “Sell and go away in May.” The same does not stand entirely true for cryptocurrencies as the category of tokens is more prone to volatility and price swings, relative to the stock market.

With Bitcoin back above the $100,000 milestone, a successful implementation of Ethereum’s Pectra upgrade and the rising stablecoin volume, it doesn’t look like the crypto sector will slow down.

Bitcoin could revisit its all-time high and Ethereum could rally nearly 20% to re-test its psychologically important $3,000 level in May 2025. Meme coins, AI tokens, utility tokens and altcoins could begin their recovery soon, following in Bitcoin’s footsteps as institutional investors show interest in relevant sectors in the crypto market.

Selling and going away may not be the best bet, when staying put, or taking profits adds more value to traders’ portfolios.

Bitcoin and altcoin summer outlook

Bitcoin monthly returns chart from Coinglass shows BTC has yielded gains for holders between 3-5 months from June to December of 2023 and 2024. If history repeats itself in the ongoing cycle, Bitcoin holders could identify opportunities to realize gains on their BTC holdings or rotate into altcoins during H2 2025, or following a re-test of the previous all-time high.

If Bitcoin revisits its all-time high, over 97,000 wallet addresses holding nearly 108,000 Bitcoin tokens would turn profitable, likely to result in profit-taking and higher selling pressure for BTC.

On May 13, Tuesday, earlier this week, the altcoin season tracker climbed to 67, the highest level in 2025. The last time the index hit this level was in December 2024. The index implies that we are closer to an “altcoin month,” meaning a period of 30 days where 75% of the top 50 cryptocurrencies outperform Bitcoin.

At the time of writing, the index is down to 55 and the outlook remains positive, with a return to December 2024 levels likely in H1 2025.

James Toledano, Chief Operating Officer at Unity Wallet shared his thoughts on Bitcoin’s current price action and whether it is in line with market expectations. Toledano said,

“Bitcoin’s current price behavior appears to be moving in line with market expectations. Anything over $100,000 is a win as we look for stabilization and price support at this level. After peaking at $109,000 in January, Bitcoin has maintained a tight trading range near $104,000 over the past week, suggesting a phase of healthy consolidation.

The dip over the past 24 hours reflects normal market volatility rather than a structural concern —there have been no market shocks, and any fluctuations appear to be demand and supply economics in action.”

The executive believes that the leveling off noted in the top crypto is a sign of increasing macroeconomic caution and this may have prompted some investors to rotate into top-tier altcoins like Ethereum (ETH) and Solana.

Capital rotation may be a real phenomenon in the ongoing Bitcoin bull market and the token’s current stabilization points to a maturing asset class that is absorbing prior gains while awaiting fresh catalysts and inputs.

Ruslan Lienkha, chief of markets, YouHodler said:

“The upward momentum in equity markets has moderated following the conclusion of tariff negotiations, as short-term traders began locking in profits, triggering corrective movements. This shift in sentiment has spilled over into riskier assets, including Bitcoin.

As a result, the current pullback appears to be a correction within a broader medium-term uptrend. However, ongoing global economic uncertainty and persistently high interest rates in the U.S. may act as headwinds, potentially capping the upside potential of this trend.”

Lienkha noted his concerns of capped gains in Bitcoin and cryptos as the market faces the likelihood of high interest rates for longer in the U.S.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.