AAVE token price has already jumped by over 132% from its lowest level in April, and a rare technical formation points to another 50% surge.

AAVE (AAVE), the biggest player in decentralized finance, continued doing well this week as the total assets in its network jumped to a record high.

According to its website, the total market size on Ethereum has soared to $33.5 billion, with those borrowed being $13 billion. The funds available to borrow have jumped to $20.45 billion.

AAVE has also been growing in other chains, like Base, Sonic, and Arbitrum. Its total market size on the recently launched Sonic has jumped to $383 million, while on Base hit $882 million this week.

AAVE’s GHO stablecoin has also gained market share as its market cap jumped to a record high of $255 million.

Data showing that futures open interest soared to $550 million, the highest point this year, further supports the uptrend. Soaring open interest indicates that AAVE has adequate demand in the futures market.

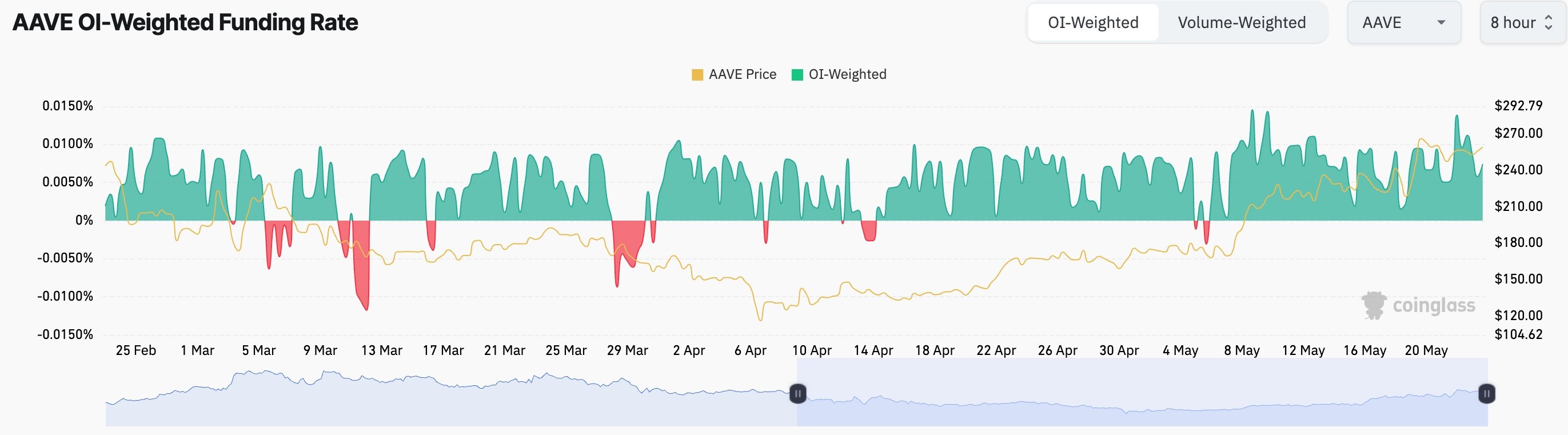

As the chart below shows, AAVE has had a positive funding rate since May 6, a sign that investors anticipate its future price to be higher than the spot one.

Its balances on exchanges have continued falling. CoinGlass data shows that 2.16 million coins are on exchanges, down from the year-to-date high of 2.72 million.

AAVE price technical analysis

The daily chart shows that AAVE price has soared in the past few weeks. This rebound happened after it formed a falling wedge pattern, a popular bullish reversal sign.

It has now moved above the 50% Fibonacci Retracement level, while the Average Directional Index has moved to 40. An ADX figure of over 25 indicates that the trend is strengthening.

AAVE has formed a golden cross as the 50-day and 200-day moving averages cross each other. Therefore, the path of the least resistance for AAVE is bullish, with the next point to watch being the last November high of $400.