Ethena surged over 140% in July, but an upcoming token unlock and whale exits now threaten to reverse its gains.

Summary

- Ethena surged over 140% in July, driven by protocol growth, stablecoin expansion, and a major buyback announcement.

- A $103.6 million token unlock scheduled for Aug. 5 and whale sell-offs have raised concerns over short-term price pressure.

- ENA is currently trading near a key support level within a bearish wedge pattern.

According to data from crypto.news, Ethena (ENA) was trading at $0.61 at press time, marking an 11% gain over the past 24 hours. The latest jump extends its 30-day rally to approximately 142%. Daily trading volume has also climbed 33%, making ENA the top-performing token of the day and placing it 41st among all cryptocurrencies by market capitalization.

What led to Ethena’s July rally?

Ethena’s July rally was not the result of a single event but rather a coordinated accumulation of bullish developments across market access, protocol growth, regulatory alignment, and whale activity.

According to DeFiLlama, the protocol’s TVL has grown by 73% in just 30 days, elevating Ethena to the sixth-largest DeFi platform globally. This places it just behind established players such as Aave, Lido, and EigenLayer.

In parallel, Ethena’s synthetic stablecoin, USDe, has experienced a dramatic rise in supply. Data shows that USDe’s circulating supply climbed 75% month-over-month, reaching $9.3 billion. This surge allowed it to overtake FDUSD and become the third-largest stablecoin by market capitalization, trailing only Tether (USDT) and USD Coin (USDC).

Large holders, or whales, have also played a critical role in fueling the rally. As reported by crypto.news, several whale wallets accumulated significant amounts of ENA throughout July.

These fundamentals were reinforced by major catalysts earlier last month. On July 11, Ethena secured a listing on Upbit, South Korea’s largest cryptocurrency exchange, boosting its visibility and liquidity in the Asian markets.

Less than two weeks later, StablecoinX announced a $360 million fundraising round, with $260 million earmarked specifically to buy back ENA tokens. This large-scale capital injection created a short-term demand shock that further accelerated price appreciation.

On the regulatory front, Ethena and Anchorage Digital announced a compliance breakthrough on July 24. Their synthetic dollar, USDtb, became one of the first stablecoins to meet the requirements of the newly introduced U.S. GENIUS Act.

Token unlock approaching

Despite Ethena’s strong performance in July, the token could soon face headwinds as a large unlock approaches.

As per Tokenomist data, 171.88 million ENA tokens, worth approximately $104.56 million, are scheduled to unlock on Aug. 5. This represents about 2.7% of the current circulating supply of around 6.35 billion tokens. So far, only 42.3% of ENA’s 15 billion total supply has been unlocked.

Token unlocks often result in additional selling pressure, particularly when market sentiment is positive. Although not every unlocked token is sold, raising supply could slow down momentum, particularly if traders choose to take advantage of recent gains.

Whales are offloading ENA

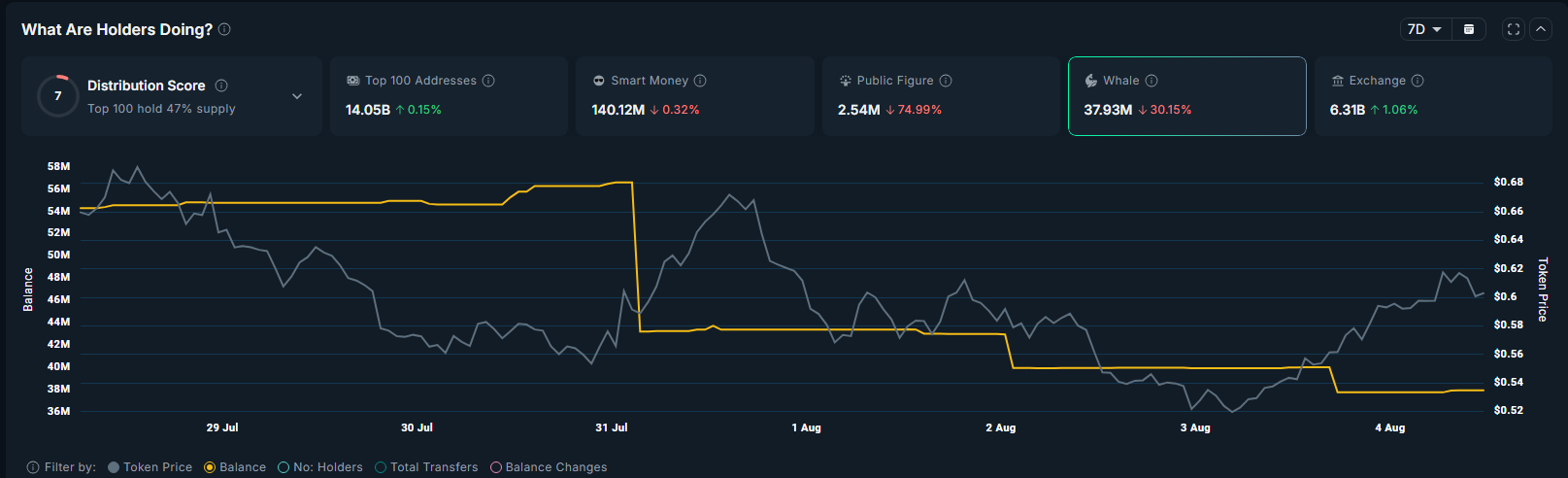

Adding to concerns, recent on-chain data points to weakening conviction among large holders. Over the past week, whale wallets have reduced their ENA holdings by 30%, now totaling 37.93 million tokens, according to Nansen. Similarly, public figure wallets, often used as sentiment proxies, have slashed their holdings by 75%, with balances dropping to just 2.54 million ENA.

Even veteran trader Arthur Hayes, who accumulated ENA in July, recently sold around $4.62 million worth of the token. He cited growing macroeconomic risks, including weak U.S. jobs data and slowing global credit growth, as reasons for shifting away from volatile assets like crypto.

Such reductions may signal that influential investors are locking in profits ahead of the unlock event, anticipating short-term price pressure. Lower holdings among whales and known public wallets often precede market pullbacks, especially when token supply is set to increase.

ENA price analysis

On the daily chart, ENA reached its year-to-date low of $0.23 on June 23. It then moved into a consolidation phase through early July before initiating a strong upward rally.

More recently, the price has formed an ascending broadening wedge, a pattern typically considered bearish due to its rising volatility and lack of directional stability. This formation often precedes a reversal, particularly when it emerges after a steep rally.

At the time of writing, ENA is trading close to the wedge’s lower trendline support at approximately $0.52. A decisive break below this level could confirm the bearish setup and trigger a broader pullback.

Momentum indicators support this weakening outlook. The MACD signal line (blue) has already crossed below the MACD line (orange), confirming a bearish crossover that signals waning upward momentum. Additionally, the Relative Strength Index (RSI) has declined to 62, still near overbought territory, but now pointing downward, indicating cooling buying strength.

If ENA fails to hold above the $0.47 psychological support level, the price may be vulnerable to further downside. A bounce at this level would temporarily invalidate the bearish structure.

However, a breakdown could open the door to a deeper correction toward $0.24, retesting its July lows. A sustained move below that could extend losses toward $0.07, which aligns with the measured target implied by the wedge pattern.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.