USDT dominance is eroding as Circle and other stablecoin competitors fight for a share of the pie.

Summary

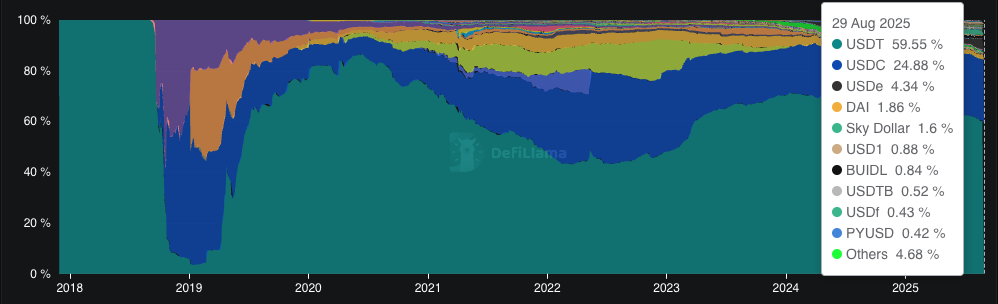

- USDT dominance fell below 60% for the first time since 2023

- Circle’s USDC is its primary competitor, nearing 30% dominance

- The passage of the US GENIUS Act is making the market more competitive

Competition among stablecoin issuers is growing. On Friday, August 29, USDT dominance fell to 59.45%, according to data from DeFiLlama. This was the first time the key figure fell to these levels since March 2023, indicating that Tether may be losing its grip on the market.

Notably, in the first half of 2024, USDT dominance hovered around 70%. At the same time, Tether’s main competitor, Circle’s USDC, controlled just 18% of the market, a figure which is now close to 30%. On the other hand, DAI’s dominance fell in that period, from around 3.5% to its current level of 1.86%.

One standout performer this year is Ethena’s USDe. Launched in December 2024, already reached 4.34% in dominance and a market cap of $12.275 billion. On the other hand, Trump World Liberty Financial’s USD1 controls 0.88% of the market.

Tether faces regulatory issues in Europe, the U.S.

Tether is not just facing increased competition. With more countries issuing stricter rules on stablecoins, its USDT is at a disadvantage. So far, Tether has declined to comply with Europe’s MiCA stablecoin framework, leading to its delisting on major exchanges.

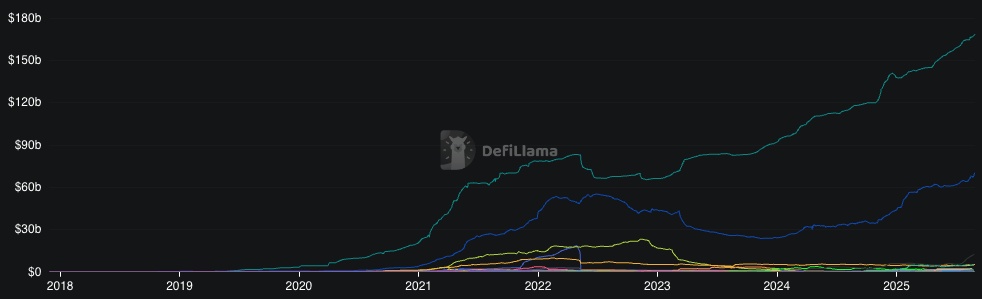

Tether may soon face the same issue in the United States, which recently passed the GENIUS Act, which requires more transparency from stablecoin issuers. Still, despite a shift in market positioning, major players, including Tether, are on the rise. Both USDT and USDC are at record levels, at $168.43 billion and $70.378 billion, respectively.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.