Despite ongoing crypto market volatility, Metaplanet opted for a leveraged strategy for its latest Bitcoin acquisition.

Summary

- Metaplanet is leveraging to acquire more Bitcoin, despite volatility

- The firm tapped an additional $130 million from its $500 million loan facility

- The Tokyo-listed firm recently announced a $135 million share offering

Due to ongoing volatility in the crypto markets, markets expect digital treasury firms to slow down their acquisitions. However, Tokyo-listed Metaplanet is not one of them. On Tuesday, November 25, the firm announced that it drew a new $130 million loan from its Bitcoin-backed credit line.

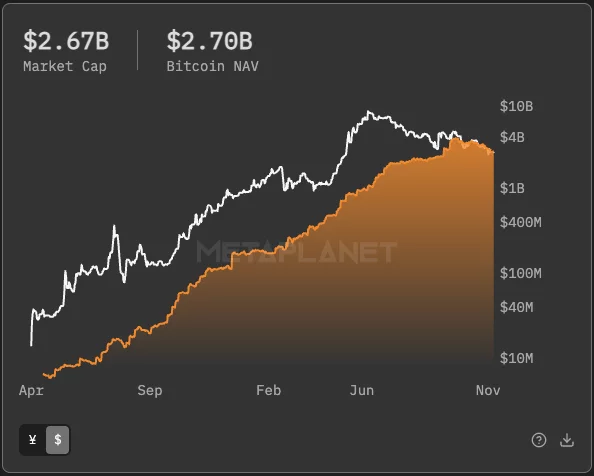

The latest loan brings Metaplanet’s total borrowings from its $500 million facility to $230 million. The firm will use to buy more Bitcoin, expand its BTC income business, and potentially repurchase shares. This makes the loan a leveraged bet, while the firm still sits on nearly 20% of unrealized loss on its current BTC holdings.

The firm will calculate loan interest in U.S. dollars, along with the spread. The term renews daily, and the firm can repay the loan at its discretion. What is more, its income strategy includes using Bitcoin as collateral to sell options.

Metaplanet makes a leveraged, risky bet

Borrowing money to buy Bitcoin is a potentially lucrative yet risky strategy. If Bitcoin goes down enough, leveraged buyers can find themselves wiped out. Firms that use it, including Michael Saylor’s Strategy, are typically more volatile than the underlying asset.

Metaplanet is using its leveraged strategy in combination with share sales. On November 20, the firm announced plans to issue $135 million worth of Class B perpetual shares. These shares mirror Strategy’s approach to BTC acquisitions, combining equity sales with borrowing.

Currently, Metaplanet’s average Bitcoin purchase price is $108,036, more than 20% higher than its current price of $87.505.