Summary

- The XRP price is currently around $2.66, with a trading range of $2.30-$2.66 and strong resistance at $2.70-$3.00.

- Whale piling is increasing, with huge investors currently owning roughly half of the circulating XRP supply.

- Derivatives markets have strong open interest and short exposure, indicating probable short squeeze conditions.

- If whales continue to accumulate and shorts unwind, XRP might rise to $3.10–$3.40.

- A failure to accumulate or a prolonged pessimistic mood might push prices down to $2.00-$2.10.

- Overall, the XRP prognosis is cautiously positive, depending on triggers and leverage dynamics.

XRP price market info

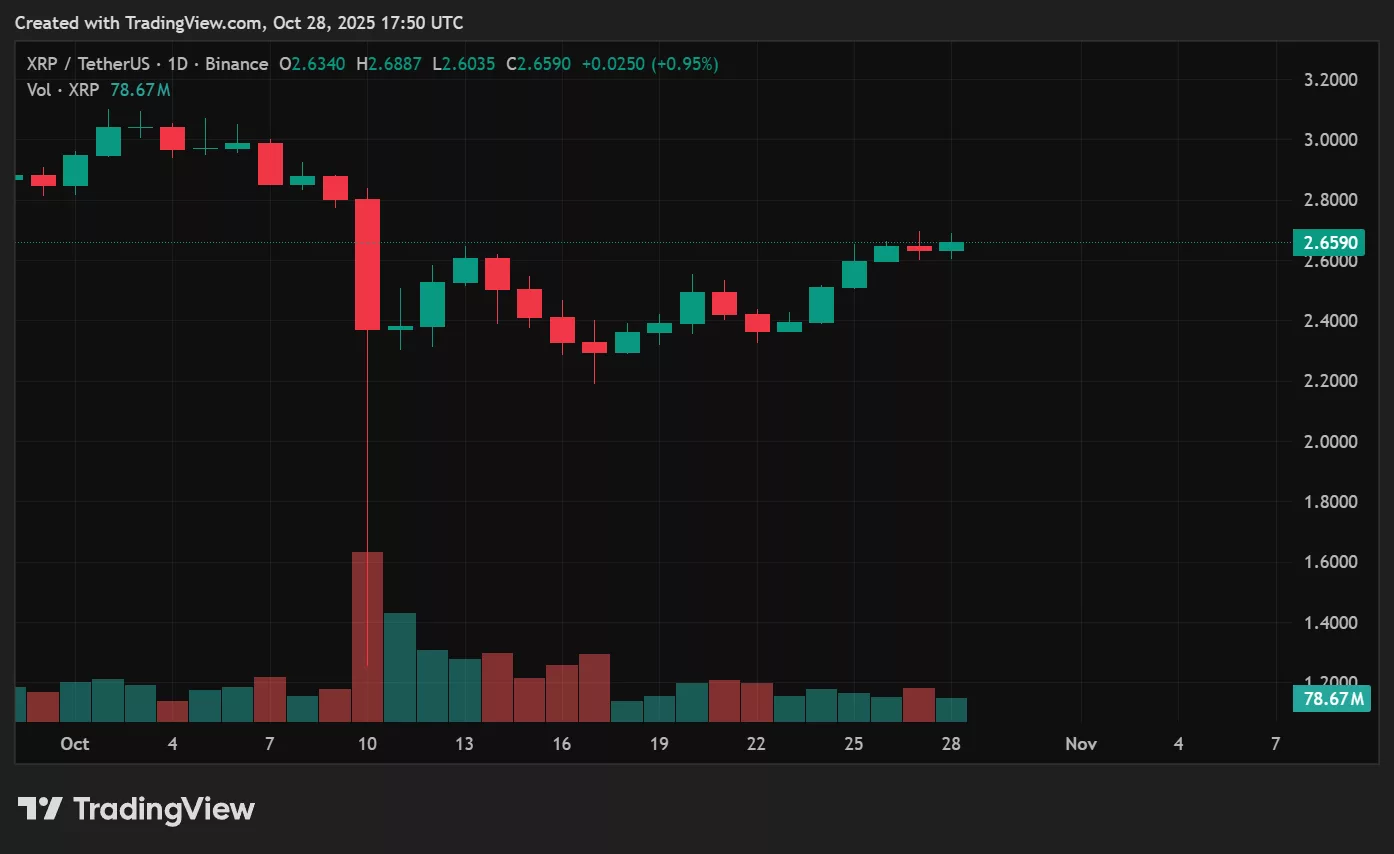

The XRP price is trading at approximately $2.66, within a range of $2.30–$2.70, with resistance near $2.70–$3.00 and support around $2.20–$2.30. Despite recent volatility, its market value is close to $158 billion, indicating that investor interest remains strong.

On-chain data suggest a significant increase in large holder activity, with wallets holding one million or more XRP reaching an all-time high of approximately 2,700. These whale wallets currently own roughly half of the circulating supply, indicating that major players are steadily increasing their holdings.

In derivatives markets, open interest has increased dramatically, with both options and futures exposure growing, suggesting that leveraged positioning is heating up. The combination of whale buildup and significant short exposure creates the conditions for a potential short squeeze if market mood shifts.

Upside outlook

If major holders continue to accumulate and leveraged short positions start to unwind, XRP price prediction models suggest that XRP may break through the crucial resistance zone of $2.70–$3.00. As short covering triggers liquidations and amplifies buying pressure, a breakout from this level could occur rapidly, targeting the $3.10–$3.40 range.

Momentum might build further if a clear catalyst arises, such as more institutional investment, ETF-related speculation, or positive regulatory developments. In this case, the speed of short liquidations would be critical; a quick unwind might result in a dramatic, short-term price spike.

Downside risks

At the moment, the XRP outlook appears balanced between long-term accumulation and short-term speculation. In a neutral scenario, the price will likely remain between $2.20 and $2.70. A genuine short-squeeze event could propel it to $3.10–$3.40, while a lack of accumulation momentum or fresh market risk could push it down toward $2.00.

Overall, while the prospects are favorable for a squeeze, the move remains highly dependent on timing, leverage dynamics, and the emergence of a decisive external catalyst.

XRP price prediction based on current levels

At the moment, XRP appears to be balanced between long-term accumulation and short-term speculation. In a neutral scenario, the price will likely remain between $2.20 and $2.70. A true short-squeeze event might propel it to $3.10-$3.40, whilst a lack of accumulating momentum or fresh market risk could push it to the $2.00 level. Overall, while the prospects are favorable for a squeeze, the move is strongly reliant on timing, leverage dynamics, and the emergence of a decisive external stimulus.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.