Bitcoin ETFs recorded $83.27 million in net outflows on December 26, extending a multi-day redemption streak as BTC struggled to reclaim $88,000.

Summary

- Bitcoin ETFs recorded $83.27M in outflows on Dec. 26, extending a five-day selloff.

- Fidelity’s FBTC led redemptions with $74.38M, while most ETFs saw zero flows.

- ETF outflows now exceed $750M as Bitcoin fails to reclaim the $90K level.

Fidelity’s FBTC led withdrawals with $74.38 million in outflows, while Grayscale’s GBTC posted $8.89 million in redemptions.

All remaining Bitcoin (BTC) ETFs recorded zero flow activity on December 26. BlackRock’s IBIT data was not updated as of press time.

Total net assets under management fell to $113.83 billion while cumulative total net inflow held at $56.82 billion. BTC dropped over 1% in the past 24 hours, trading below $88,000.

Five consecutive days of Bitcoin ETFs redemptions

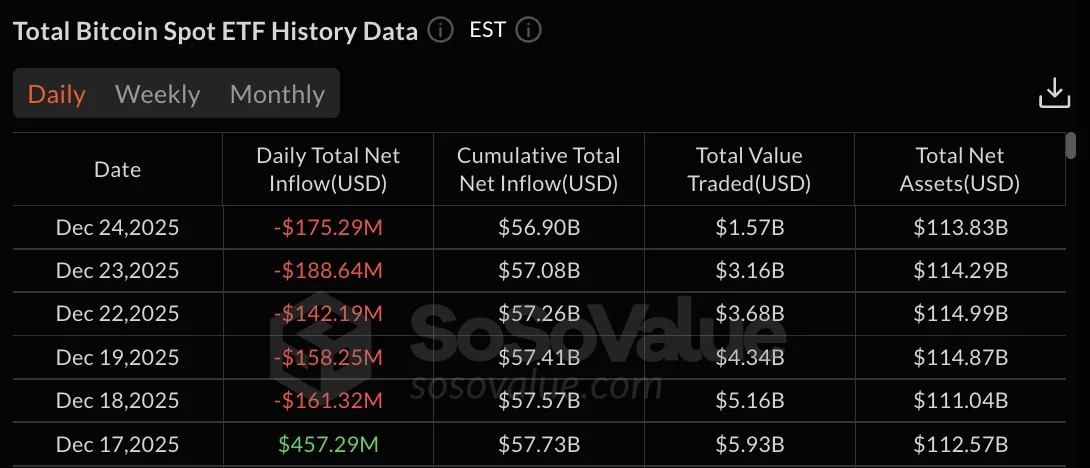

Bitcoin ETFs began the outflow streak on December 18 with $161.32 million in withdrawals following a brief rally on December 17 that attracted $457.29 million. December 19 saw $158.25 million in outflows before the weekend pause.

Trading resumed December 22 with $142.19 million in redemptions. Outflows accelerated December 23 with $188.64 million in withdrawals, followed by $175.29 million on December 24.

The December 26 outflows of $83.27 million brought the five-day total to over $750 million in net redemptions.

Total value traded fell to $1.57 billion on December 24 from $5.93 billion on December 17. The sustained outflow period has drained assets as Bitcoin price failed to maintain momentum above $90,000.

Fidelity’s FBTC dominated December 26 outflows at $74.38 million, accounting for 89% of total redemptions. Grayscale’s legacy GBTC fund posted $8.89 million in withdrawals.

Grayscale’s mini BTC trust, along with Bitwise, Ark & 21Shares, VanEck, Invesco, Franklin, Valkyrie, WisdomTree, and Hashdex all recorded zero flows.

Ethereum ETFs mirror Bitcoin weakness

Ethereum (ETH) spot ETFs also faced selling pressure, recording $52.70 million in outflows on December 24. The withdrawals followed $95.53 million in redemptions on December 23.

December 22 provided temporary relief with $84.59 million in Ethereum ETF inflows before outflows resumed. Total net assets for Ethereum products stood at $17.86 billion on December 24, down from $20.31 billion on December 11.

Cumulative total net inflow across Ethereum ETFs held at $12.38 billion. Bitcoin’s failure to break above $90,000 and hold gains has triggered profit-taking and position liquidation.